The Government Launching Its Own Cash App: The End of Physical Cash?

Last updated: Jul 30, 2023

The video is about the government launching its own cash app called fednow, which allows businesses and individuals to transfer money instantly, and discusses the potential implications of this for the future of physical cash and privacy.

This video by Journey With The Hintons was published on Apr 6, 2023.

Video length: 14:35.

The video discusses the government's plan to launch its own cash app called fednow in July.

The app is intended to provide businesses and individuals with immediate access to funds and faster money transfers. However, the video raises concerns about the potential implications of this move, such as the government having complete control over financial transactions and the invasion of privacy.

It also suggests that the app could be a way for the government to monitor and track financial activities for tax purposes.

- The government is launching its own cash app called fednow.

- Fednow allows businesses and individuals to transfer money instantly.

- There are concerns about the implications of this for the future of physical cash and privacy.

- Fednow is the Federal Reserve's new instant payment system.

- There are concerns about whether this is necessary, as private services like Zelle already exist.

The Government Launching Its Own Cash App: The End of Physical Cash? - YouTube

Introduction

- The government is launching its own cash app called fednow.

- Fednow allows businesses and individuals to transfer money instantly.

- There are concerns about the implications of this for the future of physical cash and privacy.

What is Fednow?

- Fednow is the Federal Reserve's new instant payment system.

- It is supposed to be faster than traditional banking.

- It aims to make money transfers available to more people, regardless of the size of their credit union or bank.

- During situations like the COVID-19 pandemic, Fednow could allow for instant distribution of stimulus checks.

- There are concerns about whether this is necessary, as private services like Zelle already exist.

Privacy Concerns

- If everyone is using Fednow, the government can monitor every transaction.

- This could be an invasion of privacy, as the government would have access to information about who money is being sent to and received from.

- There is concern that the government could use this information for purposes beyond just facilitating faster money transfers.

- As Fednow develops, there may be changes and alterations that could further impact privacy.

- There is a question of how much access to personal information individuals are comfortable giving to the government.

The Government Launching Its Own Cash App: The End of Physical Cash? - YouTube

Tax Reporting and Closing the Tax Gap

- Recent laws require services like PayPal, Venmo, and Cash App to report money received over $600 to the IRS.

- Fednow could potentially eliminate the need for these reports, as the IRS would have direct access to individuals' spending and income.

- There is speculation that Fednow is a way for the government to close the tax gap and ensure they are receiving all the taxes owed.

- The tax gap is estimated to be $441 billion per year.

- By having direct access to individuals' transactions, the government can better track and collect taxes.

Concerns about Privacy and Government Control

- People are concerned that the government will have access to their transactions if they use the government's cash app.

- There is a worry that the government could block certain transactions that they don't want individuals to make.

- Many people feel that this level of control by the government is too much.

- Some believe that the government is trying to transition to a cashless society.

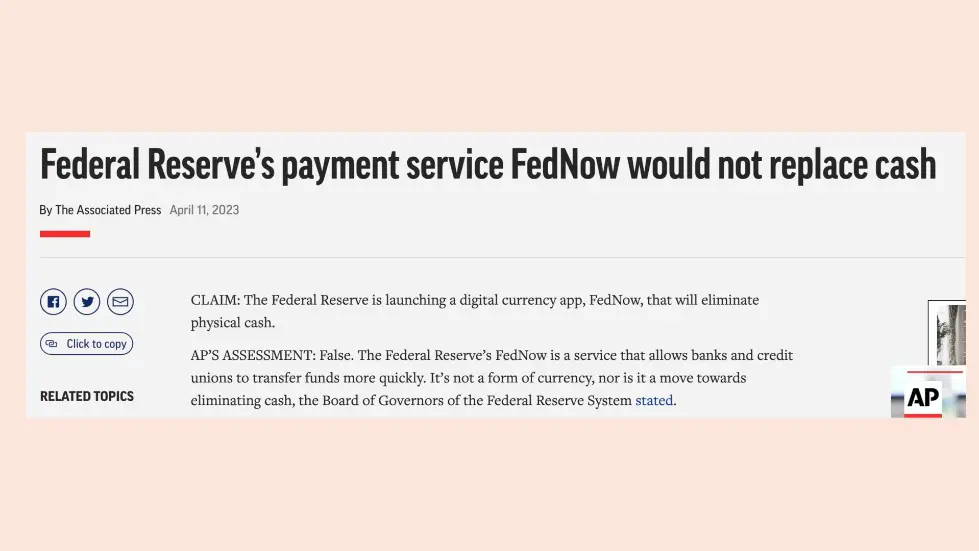

- However, the Federal Reserve states that the cash app is not a move towards eliminating physical cash.

Impact on Physical Cash and Access to Digital Payment Methods

- If everyone starts using the government's cash app, there will be less need for physical cash.

- People can use their smartphones to pay for everything, reducing the need for physical cash.

- However, not everyone has access to digital payment methods and some people are not comfortable using them.

- There are still people who prefer to use physical cash and may not switch to digital payments.

- It is uncertain whether physical cash will completely disappear, but there are concerns about its decreasing use.

Watch the video on YouTube:

The Government Launching Its Own Cash App: The End of Physical Cash? - YouTube

Related summaries of videos:

- Make $440 A Day REUSING Other People's Videos LEGALLY on YouTube (Step by Step Tutorial)

- The Government Launching Its Own Cash App: The End of Physical Cash?

- Make Thousands From Home in 4 Easy Steps (#1 Online Side Hustle of 2023)

- #1 Way To Get Rich With AI -Up To Six Figures A Month in 2023?

- I Made THIS in Just 7 Days Selling Low Content Books Online (Easy Passive Income)

- 99% of People DON’T KNOW This Is Now Happening To Their Food!

- 6 WEIRD Side Hustles That Actually Pay THOUSAND A MONTH (Start Now)

- What AI Said About Jesus & The The End of The World WILL SHOCK YOU!

- Earn $600 In Just 3 Hours With This Google Maps & ChatGPT Side Hustle!

- The Government Launching Its Own Cash App: The End of Physical Cash?