How To Complete the Credit Card Tier List FAST in 2023

Last updated: Jul 30, 2023

This video is about strategies and tips for quickly and effectively completing the credit card tier list in 2023, including understanding the sequence and timing of credit card applications and choosing cards that best fit your spending habits.

This video by Brian Jung was published on Jul 17, 2023.

Video length: 16:42.

The video is about strategies to quickly and effectively climb the credit card tier list in 2023.

The speaker discusses the importance of understanding the sequence and timing of credit card applications, as well as finding cards that best fit one's spending habits. They also mention various rules and requirements associated with different credit cards. The video provides a step-by-step sequence formula to maximize credit card benefits and points for viewers with average to great credit scores.

The speaker emphasizes the importance of using credit cards responsibly to build a positive credit history and increase chances of approval for higher tier cards in the future.

- The credit card tier list ranks credit cards based on their benefits and perks.

- Choosing the right cards that fit your spending habits is important.

- Beginner credit cards may not be valuable for frequent travelers.

- Mid-tier and premium cards offer higher ROI for travelers.

- Applying for several cards within a short period of time can harm your credit score and decrease approval chances.

- Understanding and following specific rules for different credit card issuers is crucial to avoid automatic denials.

- Having averaged to great credit is a requirement to follow the sequence.

- Start with credit cards that have more lenient requirements and build up from there.

- Following a specific sequence can help maximize credit card benefits and rewards.

How To Complete the Credit Card Tier List FAST in 2023 - YouTube

Understanding the Credit Card Tier List

- The credit card tier list ranks credit cards based on their benefits and perks.

- The higher the tier, the better the rewards, but also the higher the annual fees and requirements.

- Choosing the right cards that fit your spending habits is important.

- Beginner credit cards may not be valuable for frequent travelers.

- Mid-tier and premium cards offer higher ROI for travelers.

The Importance of Sequence and Timing

- Applying for several cards within a short period of time can harm your credit score and decrease approval chances.

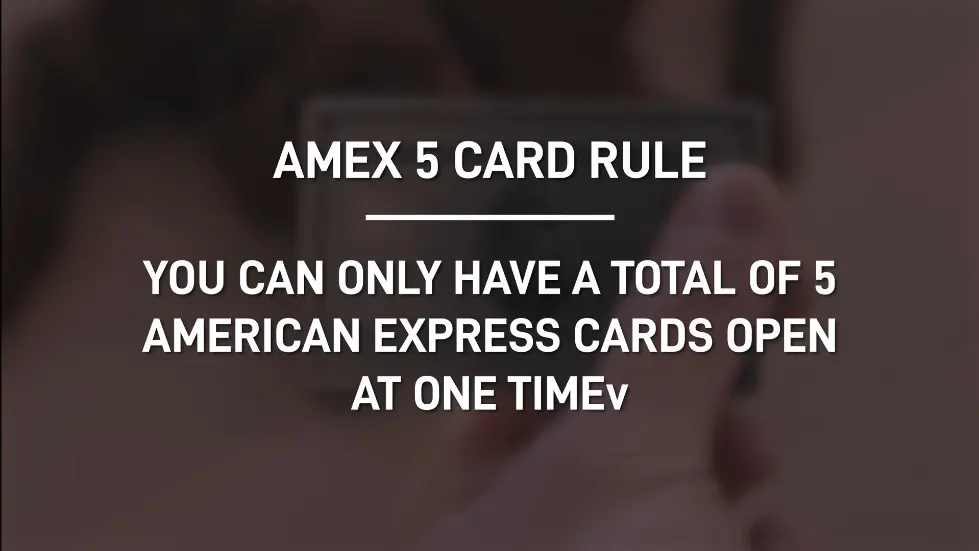

- There are specific rules for different credit card issuers, such as the Chase 5/24 rule and AmEx Five Card rule.

- Understanding and following these rules is crucial to avoid automatic denials.

- Having averaged to great credit is a requirement to follow the sequence.

- Improving credit score is possible and worth watching the video for future reference.

Strategy for Completing the Credit Card Tier List

- Start with credit cards that have more lenient requirements and build up from there.

- Having more credit card approvals increases the likelihood of getting higher tier cards from the same bank or company.

- Using credit cards responsibly helps build a positive credit score and history.

- Positive credit history makes it easier to get approved for high tier cards in the future.

- Following a specific sequence can help maximize credit card benefits and rewards.

How To Complete the Credit Card Tier List FAST in 2023 - YouTube

Example Sequence for Obtaining Multiple Credit Cards

- The speaker started with a card that cannot be named in the video.

- Building credit history with this card allowed for future approvals.

- Specific cards and banks were targeted based on their benefits and rewards.

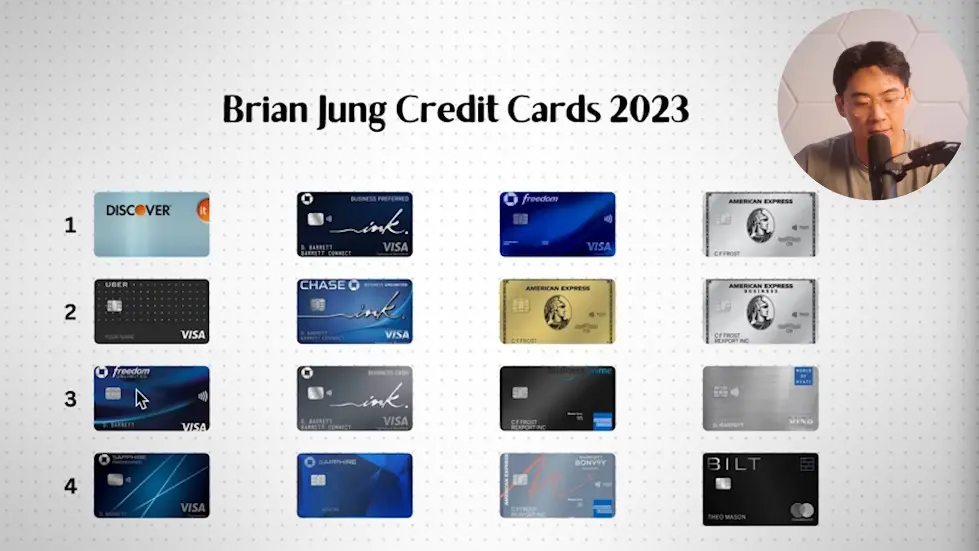

- Applying for cards strategically and responsibly led to over 15 credit cards.

- Following a similar sequence can help others achieve multiple credit cards.

Sequence of Credit Card Applications

- Initially had the Discover It and Uber Visa Barclays cards before applying for Chase cards.

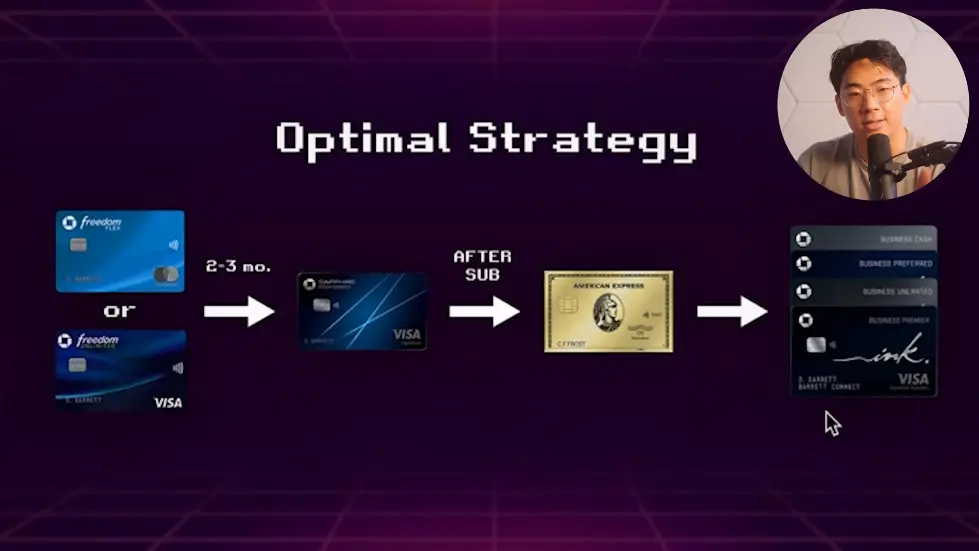

- Start by applying for the Chase Freedom Flex card as your first beginner card.

- Wait a minimum of one to two months before applying for the next card.

- Apply for a mid-tier credit card with an annual fee, such as the Chase Sapphire Preferred.

- Consider downgrading the Sapphire Preferred to the no annual fee Sapphire card later on.

Timing of Applications

- Waiting six months between applications is unnecessary; one to two months is sufficient.

- Applying for cards every one to two months or three months is safe.

- Never been denied for applying for too many cards within a short period of time.

- Apply for a Chase Freedom product first, then a mid-tier credit card.

- Consider applying for business credit cards after obtaining a few personal cards.

Choosing Chase Freedom Cards

- Chase Freedom Flex is a better choice for beginners who don't want to worry about rotating categories.

- Chase Freedom Unlimited is still a good choice if you prefer a fixed cash back rate.

- Apply for a free checking account with Chase to increase chances of approval for starter cards.

- Decent credit score should result in automatic approval for beginner credit cards.

- Chase Freedom cards offer welcome bonus offers that can be redeemed for cash or travel.

Transition to Business Credit Cards

- Business credit cards don't count towards the Chase 5/24 rule.

- Apply for Chase Ink cards to accumulate more points without affecting the 5/24 rule.

- Business credit cards offer higher welcome bonus offers, but have higher minimum spend requirements.

- Consider applying for a business credit card if you have a business or upcoming expenses.

- Learn how to apply for a business credit card without a business through YouTube videos.

Strategy for Completing the Credit Card Tier List

- Business credit cards are optional, but highly recommended.

- Downgrade the Chase Sapphire Preferred to the regular Sapphire to avoid the 48-month bonus rule.

- Plan the timing of card applications based on future travel plans and income.

- Consider the value of the Sapphire Preferred and keep it if it provides positive value.

- Calculate the ROI for the AmEx gold card based on dining and grocery spending.

Order of Card Applications

- Start with the Chase Ink cards.

- Next, apply for the Chase Freedom Flex card.

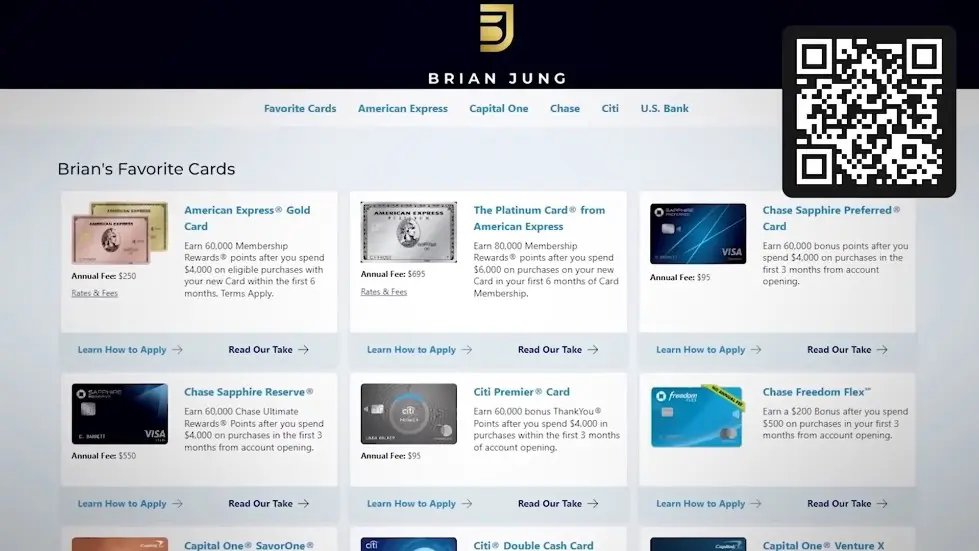

- Consider getting the American Express gold card.

- Open the door to American Express's flagship products, such as the Platinum cards.

- Choose cards based on personal preference and spending criteria.

Additional Card Options

- Consider cards like the Build card or Amazon Visa card.

- Hotel branded cards can be beneficial if you frequently stay within their brand.

- Marriott Bonvoy card and World of Hyatt card offer positive value with their annual fees.

- Explore other credit card lineups, such as U.S Bank, for potential sleeper cards.

- Start with four core cards and gradually move into mid-tier cards.

Flexibility in Choosing Cards

- You don't need to follow a specific system strictly.

- Choose cards based on personal preferences and liking.

- Remember that this is a long-term game that can last for several years.

Strategies and tips for completing the credit card tier list in 2023

- Apply for new credit cards to get the welcome bonus offer and accumulate more points.

- Downgrade or cancel the card if needed, but continue to accumulate points.

- Understand that each card is a step up the ladder and strengthens your credit card.

- Take it step by step and play your cards wisely to reach the top tier cards.

- Enjoy the elite benefits once you reach the top.

- Check out the full reviews and links in the description for more information on specific cards and their welcome bonus offers.

Watch the video on YouTube:

How To Complete the Credit Card Tier List FAST in 2023 - YouTube

Related summaries of videos:

- How to Invest in Crypto in 2023 - Full Beginner’s Guide

- 4 Best Investing Apps for Beginners To Make Money Today

- Unboxing My NEW Credit Card | $30K Credit Limit

- Chase Sapphire Preferred vs. Reserve - Which is Really Better?

- Top 7 Premium Tier Credit Cards 2024

- How The Next Crypto Bull Run Will Make Us Millions

- Amex Gold Card - 9 Secret Benefits & Tips

- Why Chase Freedom Flex is the Best Starter Credit Card

- Amex Platinum vs. Chase Sapphire Reserve | Which is Better?

- How To Invest in Crypto For Teens