5 MAJOR Credit Card Mistakes To Avoid

Last updated: Jul 30, 2023

This video is about the 5 major credit card mistakes to avoid, including not paying your balance in full and not taking advantage of referral bonuses.

This video by Brian Jung was published on Aug 7, 2023.

Video length: 12:25.

This video is about the five major credit card mistakes to avoid.

The speaker discusses the importance of paying your balance in full and not accumulating credit card debt. They also emphasize the benefits of sharing credit card rewards with others through referral programs.

The video provides solutions and tips for maximizing credit card benefits and avoiding common mistakes.

- Not paying your balance in full can lead to high interest rates and accumulating debt.

- Taking advantage of referral bonuses can increase credit card rewards.

- Understanding balance transfers and business credit cards can help avoid unnecessary interest.

- Maximizing credit card rewards requires research and understanding of redemption options.

- Maximizing welcome bonus offers involves applying for a credit card and referring friends.

- Hunting for the best welcome bonus offers requires research and comparison.

- Taking advantage of the best point redemptions involves utilizing transfer partners and exclusive services.

- Avoiding annual fees should be weighed against the benefits and perks of a card.

5 MAJOR Credit Card Mistakes To Avoid - YouTube

Mistake #1: Not paying your balance in full

- Many people continue to ride up interest and not pay off their credit card bills on time every month.

- Interest rates on credit cards are skyrocketing, ranging from 20% to 40%.

- 33% of people only pay the minimum payment amount each month.

- Exceptions include using no interest credit cards for a limited period or during financial difficulties.

- It is important to never pay interest on a credit card and treat it like a debit card.

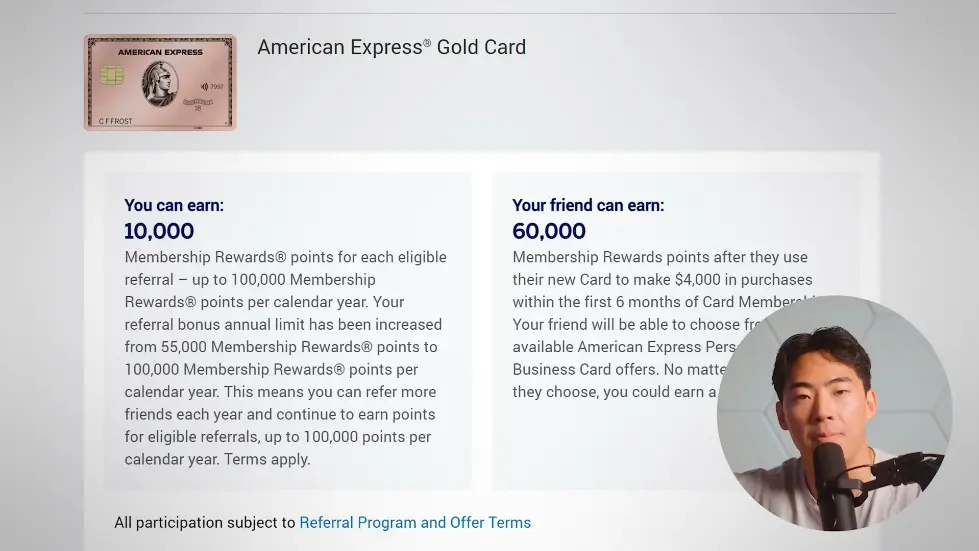

Mistake #2: Not taking advantage of referral bonuses

- Sharing credit card rewards with friends or a "player two" can exponentially increase rewards.

- Referral bonuses allow both parties to earn more points without spending a lot of money.

- Most card issuers offer referral bonuses.

- Referring a friend can earn them a higher welcome bonus offer than the public offer.

- Referring friends can also earn you a kickback of points.

Mistake #3: Not understanding balance transfers and business credit cards

- Many people are unaware of balance transfers and the benefits of business credit cards.

- Balance transfers can help consolidate debt and provide zero percent interest for a limited period.

- Business credit cards do not report to personal credit reports and can offer zero percent interest.

- Not taking advantage of these options can lead to accumulating unnecessary interest.

- Research and understand the benefits of balance transfers and business credit cards.

5 MAJOR Credit Card Mistakes To Avoid - YouTube

Mistake #4: Not maximizing credit card rewards

- Many people do not fully understand how to maximize credit card rewards.

- Research and learn about different redemption options and the best ways to use your points.

- Understand the value of different rewards and how to get the most out of them.

- Take advantage of bonus categories and promotions to earn more rewards.

- Regularly review your credit card rewards program to ensure you are maximizing your benefits.

Maximizing Welcome Bonus Offers

- Apply for a credit card and invite your spouse or partner to get the same card to maximize points.

- Make sure you can meet the required spending amount to earn the welcome bonus.

- Some credit card issuers have extended the time length to meet the spending requirement, giving you more time to earn the bonus.

- Be cautious when referring friends to credit cards, ensuring they have good spending habits and a decent credit score.

- Referring friends can help them accumulate wealth through credit card rewards.

Hunting for the Best Welcome Bonus Offers

- Many credit cards change their welcome bonus offers depending on the season or promotional incentives.

- Research and compare different welcome bonus offers to find the best one available.

- Some credit cards, like the AmEx Platinum, have varying bonus offers, ranging from 80,000 to 150,000 points.

- Consider the once-in-a-lifetime rule on welcome bonuses, as applying for the same offer multiple times may result in missed opportunities for higher bonuses.

- Use resources like the link provided in the video description to ensure you're getting the best offer on the market.

Taking Advantage of the Best Point Redemptions

- Maximize the value of your points by utilizing transfer partners instead of using them within the bank's app.

- Transfer partners may require more effort but can provide better value for your points.

- Using the Chase Ultimate Rewards portal with the Chase Sapphire Reserve can give a 50% boost on points, making them worth up to 1.5 cents each.

- Be cautious of higher prices within portals that may cancel out the boost in point value.

- Consider using an exclusive service provided by the video creator to find expert point redemption individuals for maximizing point value.

Avoiding Annual Fees

- Many beginners want to avoid annual fees, but paying them can often provide significant benefits.

- Annual fees can range from $1,000 to $3,000 or more per year on certain cards.

- Weigh the benefits and perks of a card against the annual fee to determine if it's worth it.

- Some high-end cards offer valuable benefits like airport lounge access, travel credits, and elite status.

- Consider the overall value and rewards potential before dismissing a card solely based on its annual fee.

5 Major Credit Card Mistakes To Avoid

- Avoid not paying your balance in full and not taking advantage of referral bonuses.

- If you avoid credit cards because of the annual fee, you are not fully utilizing the benefits that exist within the space.

- Higher annual fees usually come with higher welcome bonus offers and better earning rates.

- Do your own due diligence to determine if the benefits outweigh the fees.

- By getting the right cards and utilizing the rules of the points and miles game, you can come out ahead in value.

Watch the video on YouTube:

5 MAJOR Credit Card Mistakes To Avoid - YouTube

Related summaries of videos:

- How to Invest in Crypto in 2023 - Full Beginner’s Guide

- 4 Best Investing Apps for Beginners To Make Money Today

- Unboxing My NEW Credit Card | $30K Credit Limit

- Chase Sapphire Preferred vs. Reserve - Which is Really Better?

- Top 7 Premium Tier Credit Cards 2024

- How The Next Crypto Bull Run Will Make Us Millions

- Amex Gold Card - 9 Secret Benefits & Tips

- Why Chase Freedom Flex is the Best Starter Credit Card

- Amex Platinum vs. Chase Sapphire Reserve | Which is Better?

- How To Invest in Crypto For Teens